Are You Caught in the 66% Tax Trap? A Guide for High Earners

For many successful professionals in the UK, reaching an income of over £100,000 feels like a major milestone. However, what many don’t realise is that it also marks the entry into one of the most punishing and confusing parts of the UK tax system—the “66% tax trap.” This isn’t just a financial quirk; it’s a […]

Fragmented Pensions? Confusing Tax? A Clearer Financial Future Starts Here.

For many successful professionals, financial success hasn’t led to simplicity; instead, it often creates complexity. Juggling several pensions from past employers, feeling overwhelmed by paperwork, and worrying about tax inefficiencies are common frustrations. However, you are not looking for more complexity. You are seeking an expert-led strategy that provides a sense of control and peace […]

The state of social care: 27 years of promises

How to fund social care has once more moved into the political spotlight It is the turn of the year. The health secretary of the relatively new Labour government announces a commission to review the financing for long-term care of the elderly.

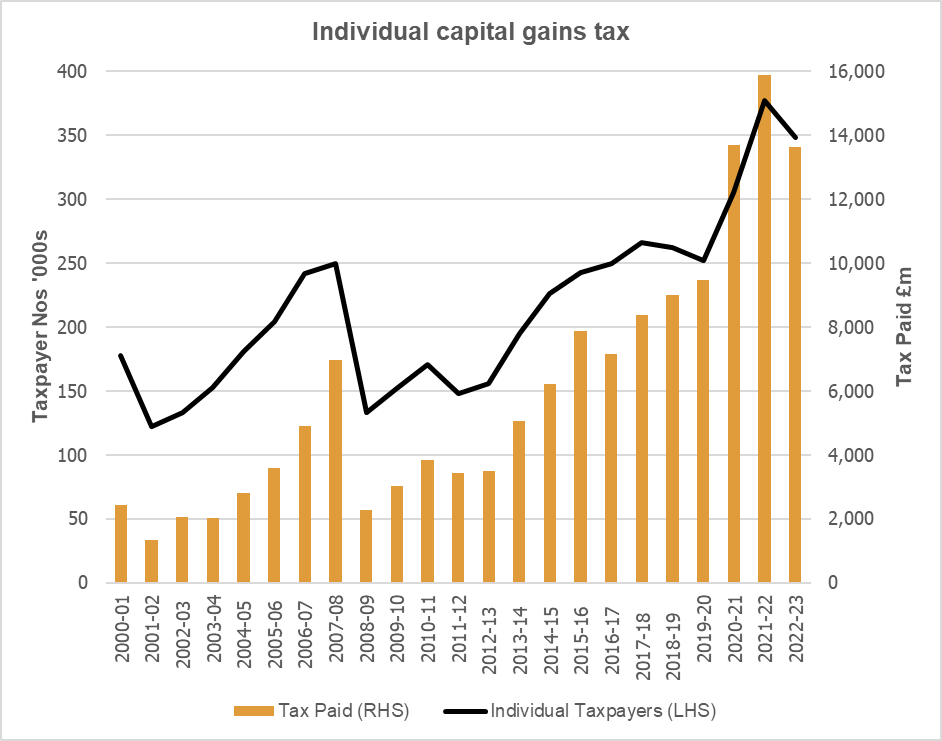

Capital gains tax: a minority sport?

Will increased capital gains tax (CGT) mean less tax gets paid?

The taxing cost of pensions

HMRC has updated its estimates for the cost of pension tax relief. Rachel Reeves will have taken note ahead of her first Budget on 30 October

A pre-Halloween scare? Looking ahead to the Autumn Budget

Rachel Reeves’s first Budget will be on Wednesday 30 October “I have to tell the House [the] Budget will involve taking difficult decisions to meet our fiscal rules across spending, welfare and tax.”

Time for increased auto-enrolment contributions?

Promised adjustments to pension law are missing a key element: increasing minimum contribution levels. The first King’s Speech of the new parliament in July contained proposals for 40 new bills, covering everything from football governance to cyber security. One familiar item on the list was a Pension Schemes Bill. The government’s briefing notes explained that […]

Prepaying / repaying student loans

Are student loans something to avoid? With the 2024/25 academic year on the horizon, student finance is again a hot topic for many parents. How hot differs slightly for the UK’s four nations as each has a subtly different way of funding students and, outside Scotland, their tuition fees. However, the broad principles are the […]

Pension decisions for the new government

Autumn won’t leave much time for the new government to settle before important pension policy decisions need to be made When MPs return to work after the summer recess, many areas of policy will require attention. Some are inheritances from the last government, while others are of the current government’s own creation. The pensions arena […]

Opening the books – the government’s spending inheritance…

The date of the next Budget has been announced, accompanied by the new Chancellor’s warning about government finances Chancellor Rachel Reeves’ first announcement on entering 11 Downing Street was the commissioning of a ‘spending inheritance’ review from the Treasury. Her decision to do so was questioned by the opposition (Conservatives), among others, who argued that […]